Closer Look at Values-Aligned Investment Framework

Written by

Brittany Priester

Portfolio Manager

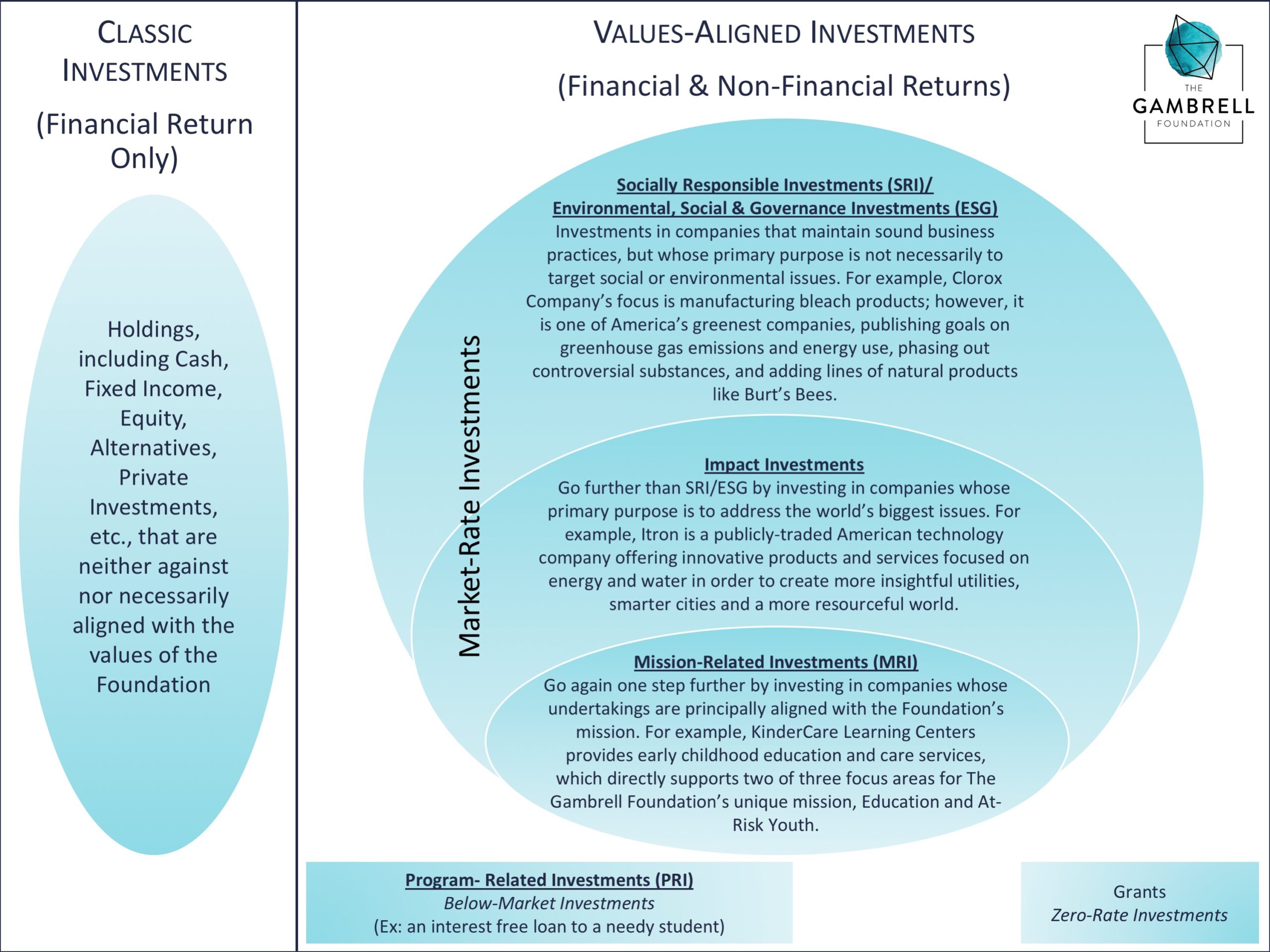

As depicted in the below illustration, the foundation’s portfolio is comprised of two overarching buckets: Classic Investments and VAIs.

Classic Investments consist of traditional holdings, such as shares of Google or a U.S. corporate bond, which we only track the financial return.

The second bucket, VAIs, comprises traditional holdings analyzed via an unconventional lens tracking both the financial return and non-financial return (e.g. impact return, social return, environmental return, etc.) Within VAIs, there are three groupings: zero-rate investments (i.e. grants) produce no return, below-market investments (e.g. Program-Related Investments or PRIs) yield subpar returns and market-rate investments generate competitive returns.

Grants are self-explanatory and other sections of the website elaborate on the foundation’s grant making.

Within market-rate investments, we classify investments into the following three subcategories:

- Socially Responsible Investments (“SRI”), or Environmental, Social and Governance Investments (“ESG”), is the broadest grouping comprised of companies that adhere to sound business practices while providing services and products that do not solely target social or environmental issues. For example, Cisco Systems is an American technology company that emphasizes environmental sustainability as evidenced by renewable energy accounting for 80% of the company’s worldwide electricity use.

- Impact Investments have a narrower focus than SRI/ESG investments, including companies whose core products and services exclusively address the world’s largest social and environmental problems. For instance, CT Environmental Group is a Chinese wastewater company uniquely positioned to impact the health and well-being of China’s population and its natural environment, targeting an urgent social and environmental concern provided widespread pollution has strained China’s water resources.

- III.Mission-Related Investments (“MRIs”) is the most concentrated subcategory provided it targets investments in companies whose activities are explicitly aligned with the foundation’s unique mission. Provided education is one of three pillars of The Gambrell Foundation’s mission, an investment in SEEK, an Australian company that matches underserved working-class job searchers with employers and offers online training and education in an effort to address the education and training gap, is an example of a MRI for this specific foundation.

Provided the uniqueness of PRIs, I will elaborate on them in a separate article given they warrant a more in-depth analysis.